A Ponzi scheme is a type of investment fraud where returns to existing investors are paid using funds collected from new investors, rather than from legitimate profits. Organizers often promise high returns with little or no risk, making the scheme appear highly attractive. However, in reality, the money is rarely invested in any legitimate venture; instead, it is used to pay earlier investors and sometimes kept by the fraudsters for personal gain.

Ponzi schemes rely on a continuous inflow of new money to sustain the payouts. When it becomes difficult to recruit new investors, or when a large number of existing investors attempt to withdraw their funds, the scheme collapses, often leaving most participants with significant financial losses.

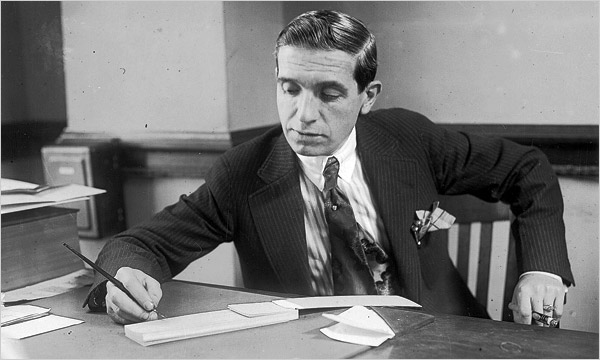

The term “Ponzi scheme” comes from Charles Ponzi, who became infamous in the 1920s for defrauding investors through a postage stamp speculation scam. His scheme illustrated the dangers of investment frauds that promise unrealistically high returns.

Charles Ponzi – The Man Behind the Infamous Ponzi Scheme

Charles Ponzi (1882–1949) was an Italian-born swindler who became infamous in the United States for creating the first large-scale Ponzi scheme in the early 1920s. He promised investors extraordinary profits by exploiting price differences in international postage coupons, claiming he could buy them cheaply abroad and redeem them at higher values in the U.S.

Ponzi’s scheme attracted thousands of investors, promising returns of up to 50% in just 45 days. Initially, he did pay some investors using the funds from new participants, which created a sense of legitimacy and attracted even more money. However, Ponzi was not actually investing in postage coupons at the scale he claimed, and the majority of the funds were used to pay earlier investors or kept by Ponzi himself.

By 1920, the scheme collapsed under its own weight, causing millions of dollars in losses for investors and making Ponzi a household name in financial fraud history. He was arrested, tried, and sentenced to prison. Ponzi’s story has since become a classic example of investment fraud, teaching investors the dangers of promises that seem “too good to be true.”

Ponzi’s legacy also led to the term “Ponzi scheme,” now used worldwide to describe similar fraudulent investment operations. Today, his story is studied in finance, law, and ethics courses as a cautionary tale.

Methods – How Ponzi Schemes and HYIPs Operate

Ponzi schemes and many high-yield investment programs (HYIPs) use specific methods to attract investors and create the illusion of legitimacy and profitability. Some common methods include:

- Referral Programs: Many schemes reward users for bringing in new investors, creating a network effect that fuels growth.

- Social Media Promotion: Scammers heavily promote their platforms on YouTube, Instagram, Telegram, and other social media to reach a wide audience quickly.

- Fake Proof of Profits: Websites often display fabricated account balances or fake testimonials to convince investors of profitability.

- Cryptocurrency Transactions: Many modern Ponzi schemes and HYIPs use Bitcoin, Ethereum, or stablecoins for deposits and withdrawals, exploiting the speed and anonymity of crypto.

- Limited-Time Offers & Urgency: They pressure potential investors with “limited-time offers” or promised high returns to encourage quick deposits.

- Layered Investment Plans: Some offer multiple investment packages with increasing promised returns to lure investors into reinvesting or adding more funds.

Understanding these methods helps investors recognize warning signs, avoid scams, and make safer financial decisions.

Red Flags – Warning Signs of Ponzi Schemes and HYIPs

High-Yield Investment Programs (HYIPs) and Ponzi schemes often use tactics that can mislead investors. Recognizing red flags early is crucial to avoid financial loss. Common warning signs include:

- Unrealistic Returns: Promises of extremely high profits with little or no risk are almost always fraudulent.

- Anonymous or Unverified Operators: The people behind the platform are hidden or provide fake contact information.

- No Regulatory Oversight: Legitimate investment platforms are registered and monitored by financial authorities. HYIPs often operate outside legal frameworks.

- Pressure to Invest Quickly: Urgent appeals, limited-time offers, or referral incentives to encourage immediate deposits.

- Withdrawal Issues: Delayed, partial, or blocked withdrawals signal a potential scam.

- Fake Testimonials or Proofs: Fabricated account balances, reviews, or payment proofs to create a false sense of legitimacy.

- Over-Reliance on Social Media: Heavy promotion via social networks instead of transparent investment reporting.

Being aware of these red flags helps investors make informed decisions and protect their money from scams.